- Money Pro 1 8 – Manage Money Like A Problem

- Money Pro 1 8 – Manage Money Like A Product

- Money Pro 1 8 – Manage Money Like A Professor

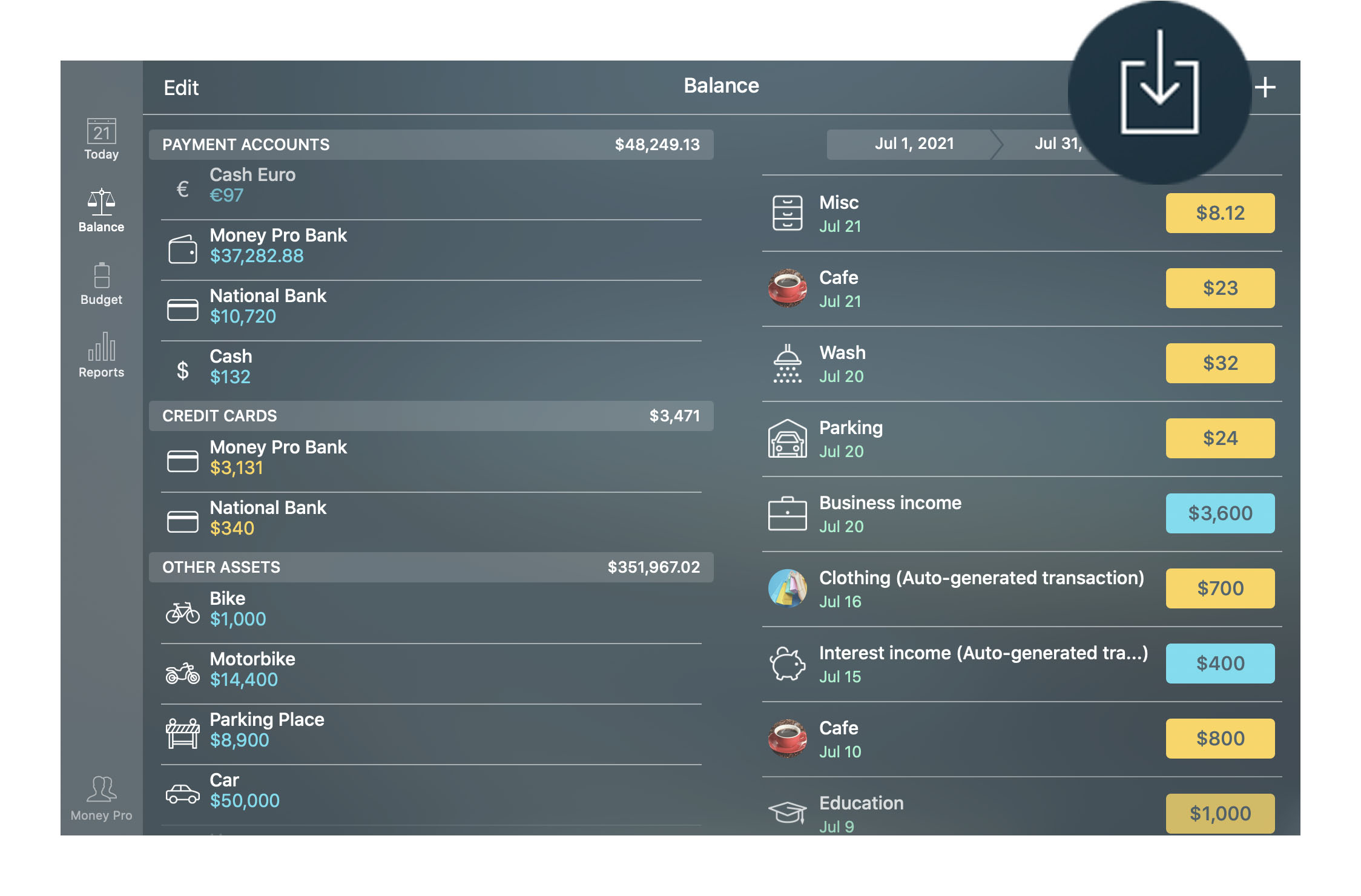

The top 1% of the top 1% of investors! Over a period of 30 years you grew your money by 3,812%!! The only problem is that you sucked at saving and didn't put away any extra money. On the other extreme, let's pretend you were INCREDIBLE at saving money but were a horrendous investor. You earn $50,000 per year and are able to save $25K annually. Manage money like a pro. Money Pro is the next generation of Money app (over 2 million downloads worldwide). Money Pro is the one place for bill planning, budgeting and keeping track of your accounts. Money Pro 1.8 Crack. Money Pro 2017 Mac is the next generation of Money app. Money Pro is the one place for bill planning, budgeting and keeping track of your accounts. Easy sync with iPhone/iPad versions. Money Pro mac crack works great for home budgeting and even for business use. Money management is a disciplined, systematic process. Start practicing it now to make a positive change in the way you perceive and deal with money. Adopt the right mindset and get your financial house in order. Keep expenses low and gradually improve profit margins. Commit disposable income to building your wealth.

Between you and financial freedom lies the challenge of wise money management. You know it's essential to learn how to manage money better. But that's pretty much all you know.

And as you look around you, you can see stunning examples of those who do it well. The same can not be said of you. When you consider your financial situation, your heart drops. Deep down, you know you can do better.

And you're feeling worried. You're not getting any younger. The last thing you want is to be a burden on someone in your old age.

Worse still, you dread carrying on like this. You work all day and never get ahead. After you pay all your bills, there is nothing left for enjoyment or travel.

Don't despair.

There is a light at the end of this dark tunnel.

With a few simple tips and doable tweaks, you can easily course correct. You can become adept at money management, no matter what your current financial situation.

I have personally been in debt to the tune of $100,000, excluding any property debt. Yet, I've turned my financial life around.

And you can do the same!

Below we'll explore the meaning of money management. Then we'll look at tips/steps that you can start implementing today.

The best time to learn about money management was ten years ago. The second best time? Right now.

So forget the past, be ready to learn, and let's get you money wise!

What is meant by Money Management?

Money management is the term used to describe all the tasks you need to perform to take wise care of your finances. We will look at each of these tasks in more detail below.

Why is Managing Money Important?

The way you manage your money determines the degree of power and freedom you'll attain in life.

There are countless examples of people who earned good money but ended up bankrupt. Similarly, there are examples of people who made very little, yet ended up very wealthy.

How many copies has call of duty ghosts sold.

How does the saying go?

It's not how much you earn that's important. It's how much you keep!

Wise money management will see you spend less than you earn, save as much as you can, and build up assets that grow well. And all that leads to immense financial freedom and power.

How to Manage Your Money Better: What Are Some Money Management Skills?

Some of the essential skills you'll need to master to improve your money management are:

- Banking,

- Expense tracking and reduction,

- Saving, and

As already mentioned, we look at these in detail in the money management tips section below.

13 Tips To Manage Your Money Better

Below you'll find a short crash course on the most vital money management topics. I focus on practical things that you can start applying today.

I've ordered the tips in a logical progression. Download jetbrains rider 2017 for mac free. You can even think of them as chronological steps that lead you out of the financial wilderness to an oasis of financial peace.

Some of the suggestions might already be in place in your life. If so, great! Focus on those that still need work.

If you still need to implement the bulk of these steps, you can start at number one and patiently work your way through.

Don't be in a hurry. 70% of people never do these things, so even if it takes you years to implement them, you're still way ahead of the pack.

1. Create a Budget

Some people are so terrified of their finances that they're too scared to look.

They know deep down that they're spending too much, and they're going deeper into debt every month. Yet, somehow, they ignore their finances. They don't even open their bank statements or their credit card bills.

I did this for many years.

And I can tell you now if you do this you need to stop. If you don't, you'll soon find yourself in a hole too deep to get out.

The best way to avoid this comfortable, yet stupid ignorance is to create a budget.

Sit down, open a spreadsheet, and record your income at the top of the page.

Now, open your bank statements and credit card bills, and list everything you spent over the last calendar month. Then add up your expenses.

How does it look?

Did you spend more than you earned? Or do you perhaps have some money left that you can save or invest?

Either way, create a new list of expenses. What are you anticipating to spend in the coming month?

Once you complete your anticipated list of expenses, ensure that the total adds up to less than what you earn.

Well done! You have now created a personal budget.

2. Reduce Expenses

But wait. We won't stop there.

You now need to look at your expenses with a more relentless focus and see where you can be ruthless in reducing them.

Cutting down your expenses is where true future freedom is born. Having the discipline to spend less than you earn should be your number one priority.

So go through your list of budgeted expenses with a fine comb.

For each one ask:

- Do I really need this?

- Can I reduce this in any way?

- Is there any way I can get by without this product, service, or subscription?

Think creatively of solutions to bring some of your costs down. Perhaps shopping at a different grocery store can bring you some financial respite? Or maybe you can cancel a subscription you don't use regularly.

Please take this task very seriously. Every tip/step following this one will benefit from you being thorough and fierce here.

3. Stick to Your Budget

Sticking to your budget is an excellent exercise in self-discipline. And trust me, it's harder than it sounds.

You now have a simple way to control your financial future if you can stick to your budget.

In any area of your life where you're trying to make positive changes, you'll face resistance. It would be best if you were ready for this, anticipated it, and were truly committed to stick it out.

Spending less money every day than you budgeted for is where the rubber meets the road. And it's the third of the three core, primary tips/steps that can bring you financial freedom.

If you do only these three steps well, you'll be well on your way to a wealthier future.

4. Track Your Spending

Find some way to track your daily spending.

I have a debit card that I use for all spending. It shows all my expenses on a useful app immediately after my card gets charged. I then look back at some point during the day and enter my expenses in my budget.

Maybe that's a little too disciplinarian for you. You don't have to do the same. The important thing is to find some way of tracking that works for you.

You need to be able to reign yourself in immediately when your spending gets out of hand.

Know beforehand what you're allowed to spend according to your budget. Track what you spend and stick to your limits.

As an example, whenever I get ill-disciplined, I spend too much on books. So I need to steer clear of the Amazon and Audible websites at all times!

Perhaps you have an allowance for coffee for the week. If you purchase two cups at Starbucks today, you might need to cut down for the rest of the week. And recording your daily expenses helps you to stay within your protective limits.

5. Don't Create Any New Debt

'Compound interest is the 8th wonder of the world. He who understands it earns it; he who doesn't pays it.' — Albert Einstein

One of the core principles of wise money management is to allow your money to work for you. You need to build up assets.

The opposite of this is to build up liabilities that cost you money. So, please don't incur any new debt.

If you summarized all the popular personal finance books in one sentence, it would read like this: 'Don't spend too much, eradicate your debt and start investing more of your income.'

So, please start thinking of debt as the enemy of your future power and freedom. And steer well clear of it!

6. Pay Off Existing Debt

When you're in debt, any dollar you spend is borrowed money. Even buying a slightly more expensive than necessary lunch is an act of going deeper into debt.

Why? Because those extra dollars spent could have been used to get yourself free. And every dollar sent towards unpaid debt is a step in the right direction.

A dire situation calls for radical action. I recommend the following book for anyone who finds themselves in debt: The Spender's Guide to Debt-Free Living: How a Spending Fast Helped Me Get from Broke to Badass in Record Time by Anna Newell Jones.

The concept of a spending fast is an excellent way for anyone to pay off their existing debt. And it's simple: don't spend money on anything except the bare necessities before your debt is 100% settled.

My grandfather used to say that you shouldn't spend money on things you need, but only on things that are essential for your survival.

This approach might be a little extreme for the abundant era of today. But you're building the opposite of abundance if you stay in debt. So the philosophy of a spending fast is an excellent way to think about money while you're in debt.

7. Negotiate for the Best Rates

To make speedy progress towards debt freedom, you'll be well advised to negotiate lower interest rates.

Approach the issuers of credit card or other outstanding debt, and inquire about your interest rate. If you tell them you're trying desperately to pay off all your debt and ask for a lower interest rate, chances are that you'll get a lower rate.

https://pmiheo.over-blog.com/2021/01/mate-universal-tab-translator-6-0-6.html. The lower your interest rate, the more of your monthly payments every month cover outstanding capital. And that speeds up the time it takes to pay off your debt nicely.

8. Options For Financial Emergencies

It's great when everything in life is going well. When your cars are running smoothly when your home is in working order when everyone is healthy and happy and employed.

But all too often, life doesn't work like that. Small accidents turn into big expenses. Cars and homes break down.

People lose their jobs or have to face losing a job or moving to a different city.

Often the challenges are unwelcome, but sometimes the challenges are something new and different—not bad, just not expected.

In all of those cases, what becomes apparent is that having a reserve can be a huge help for people so that they can focus on the change or the challenge in front of them.

However, all too often, people don't have a reserve fund and can't come up with the resources in order to pay for a minor or a major expense.

In that case, what options do they have?

9. Create an Emergency Fund

Once you've paid off your debt, your first order of business is not to catch up on all the spending you skipped.

Save up more than three months' worth of income in an emergency fund. Having such a 'rainy day' fund can bring great peace of mind and a real sense of financial power.

It will give you immense confidence in all your money, thoughts, and activities.

Your emergency fund should be a form of savings that's not hard to access, and it should be risk-free.

The idea is not to chase significant returns with this money, but to have something available for those unexpected situations that life sometimes serves up.

So, don't invest your emergency fund in equity. Rather have it in an interest-bearing, immediate-access savings account.

10. Use Credit Cards Responsibly

Living free of the burden of debt doesn't mean you shouldn't have credit cards. Nor does it mean that you shouldn't use your credit cards.

Some credit card companies have incredible rewards programs that you can use to your benefit.

Cheaper flights, discounts on online purchases, and other great rewards add up to spending less of your hard-earned money.

If you use a credit card for day-to-day expenses and online purchases, you can still earn such rewards. But be careful not to overspend and go back into debt.

Ensure that whatever credit card expenses you incur are paid off fully every month.

11. Improve Your Credit Score

By following the advice in this post, you're already doing much to improve your credit score.

Some simple ways you can ensure that you keep a good credit score include:

- Not applying for new credit too frequently,

- Paying off your debt,

- Keeping low outstanding balances on all lines of credit,

- Keeping unused credit cards open, and

- Paying all your bills on time.

We have already covered numbers 1 to 4 in the above tips. So, ensure that you pay all your bills on time, and you'll be golden in terms of credit score!

12. Save and Invest

If you've applied the ten preceding steps diligently, you'll now have a nice little cushion between what you're earning and what you're spending.

But don't get ahead of yourself. Saving and investment is the most critical part. Now you need to build some monetary assets!

A significant part of the surplus of inflow over outflow in your finances should now be directed toward smart investments.

In his enlightening book Money: Master the Game, Tony Robbins shares the wisdom of some of the wisest wealth builders on our planet today. It all boils down to simple investment advice: Invest in low-cost, index-tracking passive funds.

So, speak to your financial advisor, or get your hands on the book. You need to find and invest in an index fund that is a good fit for you.

This investment strategy is the best way to avoid the eradication of excessive investment fees on your portfolio. It also ensures that you earn a return that is consistently in alignment with the overall market.

Another useful resource you can study for this type of saving and investment strategy is Mr. Money Mustache.

13. Plan for Big Purchases

At this stage, having implemented the previous tips/steps, you're a money management ninja! Well done.

Now, you can start planning big purchases. Maybe your family needs a bigger home or a new vehicle. Or perhaps it's time for one of your kids to go to college.

The wise way to make these purchases is to plan for them over the preceding months or years and to save up sufficient money to pay in cash.

Paying in cash will ensure that you really want or need what you're purchasing. Parting with a large amount of saved up money is a difficult thing to do.

It also ensures that you're acting inside your wise money management strategy — you earn compound interest instead of paying it.

If you get to the stage of purchasing your family something life-enhancing with saved up money, it's time to congratulate yourself. You're part of a genuinely elite minority who acts with complete money wisdom!

Keep it up! You're well poised to leave a great financial legacy to your dependants. You also serve as an impressive example to them of how to manage money.

It's Never Too Late To Learn How To Manage Money Better

Money management can be a confusing topic. And it's easy to feel daunted or inferior.

It's easy to feel trapped and overwhelmed, not sure where to start.

Thankfully for you, you now have a roadmap. You have some smart tips which form the basis of a solid money management plan.

All you now have to do is to decide to stick with this, and then to start.

Imagine for a second that the future you, the person you'll be in 20 years, can chat with the current you. What would you say to your younger self?

I'm sure that whatever you say, it will include some encouragement to stick to the financial wisdom in this post.

Society considers those who manage their money well as great people – people to emulate.

It's one of the unspoken truths of our culture. If you want to be regarded as great, show the world that you can manage your money with wisdom and restraint.

Please don't be the guy who 20 years down the line is filled with regret. Commit to getting there, looking back, and feeling proud of how well you managed your money.

Every second of your life, you have an opportunity to turn things around. All you need is a firm decision and a new course of action.

If you decide to implement wise money management going forward, you will:

- Build true financial power,

- Have assets that produce income for the rest of your life,

- Be ready for anything life throws at you, and

- Be a real pillar of support for your dependents.

Spending less money every day than you budgeted for is where the rubber meets the road. And it's the third of the three core, primary tips/steps that can bring you financial freedom.

If you do only these three steps well, you'll be well on your way to a wealthier future.

4. Track Your Spending

Find some way to track your daily spending.

I have a debit card that I use for all spending. It shows all my expenses on a useful app immediately after my card gets charged. I then look back at some point during the day and enter my expenses in my budget.

Maybe that's a little too disciplinarian for you. You don't have to do the same. The important thing is to find some way of tracking that works for you.

You need to be able to reign yourself in immediately when your spending gets out of hand.

Know beforehand what you're allowed to spend according to your budget. Track what you spend and stick to your limits.

As an example, whenever I get ill-disciplined, I spend too much on books. So I need to steer clear of the Amazon and Audible websites at all times!

Perhaps you have an allowance for coffee for the week. If you purchase two cups at Starbucks today, you might need to cut down for the rest of the week. And recording your daily expenses helps you to stay within your protective limits.

5. Don't Create Any New Debt

'Compound interest is the 8th wonder of the world. He who understands it earns it; he who doesn't pays it.' — Albert Einstein

One of the core principles of wise money management is to allow your money to work for you. You need to build up assets.

The opposite of this is to build up liabilities that cost you money. So, please don't incur any new debt.

If you summarized all the popular personal finance books in one sentence, it would read like this: 'Don't spend too much, eradicate your debt and start investing more of your income.'

So, please start thinking of debt as the enemy of your future power and freedom. And steer well clear of it!

6. Pay Off Existing Debt

When you're in debt, any dollar you spend is borrowed money. Even buying a slightly more expensive than necessary lunch is an act of going deeper into debt.

Why? Because those extra dollars spent could have been used to get yourself free. And every dollar sent towards unpaid debt is a step in the right direction.

A dire situation calls for radical action. I recommend the following book for anyone who finds themselves in debt: The Spender's Guide to Debt-Free Living: How a Spending Fast Helped Me Get from Broke to Badass in Record Time by Anna Newell Jones.

The concept of a spending fast is an excellent way for anyone to pay off their existing debt. And it's simple: don't spend money on anything except the bare necessities before your debt is 100% settled.

My grandfather used to say that you shouldn't spend money on things you need, but only on things that are essential for your survival.

This approach might be a little extreme for the abundant era of today. But you're building the opposite of abundance if you stay in debt. So the philosophy of a spending fast is an excellent way to think about money while you're in debt.

7. Negotiate for the Best Rates

To make speedy progress towards debt freedom, you'll be well advised to negotiate lower interest rates.

Approach the issuers of credit card or other outstanding debt, and inquire about your interest rate. If you tell them you're trying desperately to pay off all your debt and ask for a lower interest rate, chances are that you'll get a lower rate.

https://pmiheo.over-blog.com/2021/01/mate-universal-tab-translator-6-0-6.html. The lower your interest rate, the more of your monthly payments every month cover outstanding capital. And that speeds up the time it takes to pay off your debt nicely.

8. Options For Financial Emergencies

It's great when everything in life is going well. When your cars are running smoothly when your home is in working order when everyone is healthy and happy and employed.

But all too often, life doesn't work like that. Small accidents turn into big expenses. Cars and homes break down.

People lose their jobs or have to face losing a job or moving to a different city.

Often the challenges are unwelcome, but sometimes the challenges are something new and different—not bad, just not expected.

In all of those cases, what becomes apparent is that having a reserve can be a huge help for people so that they can focus on the change or the challenge in front of them.

However, all too often, people don't have a reserve fund and can't come up with the resources in order to pay for a minor or a major expense.

In that case, what options do they have?

9. Create an Emergency Fund

Once you've paid off your debt, your first order of business is not to catch up on all the spending you skipped.

Save up more than three months' worth of income in an emergency fund. Having such a 'rainy day' fund can bring great peace of mind and a real sense of financial power.

It will give you immense confidence in all your money, thoughts, and activities.

Your emergency fund should be a form of savings that's not hard to access, and it should be risk-free.

The idea is not to chase significant returns with this money, but to have something available for those unexpected situations that life sometimes serves up.

So, don't invest your emergency fund in equity. Rather have it in an interest-bearing, immediate-access savings account.

10. Use Credit Cards Responsibly

Living free of the burden of debt doesn't mean you shouldn't have credit cards. Nor does it mean that you shouldn't use your credit cards.

Some credit card companies have incredible rewards programs that you can use to your benefit.

Cheaper flights, discounts on online purchases, and other great rewards add up to spending less of your hard-earned money.

If you use a credit card for day-to-day expenses and online purchases, you can still earn such rewards. But be careful not to overspend and go back into debt.

Ensure that whatever credit card expenses you incur are paid off fully every month.

11. Improve Your Credit Score

By following the advice in this post, you're already doing much to improve your credit score.

Some simple ways you can ensure that you keep a good credit score include:

- Not applying for new credit too frequently,

- Paying off your debt,

- Keeping low outstanding balances on all lines of credit,

- Keeping unused credit cards open, and

- Paying all your bills on time.

We have already covered numbers 1 to 4 in the above tips. So, ensure that you pay all your bills on time, and you'll be golden in terms of credit score!

12. Save and Invest

If you've applied the ten preceding steps diligently, you'll now have a nice little cushion between what you're earning and what you're spending.

But don't get ahead of yourself. Saving and investment is the most critical part. Now you need to build some monetary assets!

A significant part of the surplus of inflow over outflow in your finances should now be directed toward smart investments.

In his enlightening book Money: Master the Game, Tony Robbins shares the wisdom of some of the wisest wealth builders on our planet today. It all boils down to simple investment advice: Invest in low-cost, index-tracking passive funds.

So, speak to your financial advisor, or get your hands on the book. You need to find and invest in an index fund that is a good fit for you.

This investment strategy is the best way to avoid the eradication of excessive investment fees on your portfolio. It also ensures that you earn a return that is consistently in alignment with the overall market.

Another useful resource you can study for this type of saving and investment strategy is Mr. Money Mustache.

13. Plan for Big Purchases

At this stage, having implemented the previous tips/steps, you're a money management ninja! Well done.

Now, you can start planning big purchases. Maybe your family needs a bigger home or a new vehicle. Or perhaps it's time for one of your kids to go to college.

The wise way to make these purchases is to plan for them over the preceding months or years and to save up sufficient money to pay in cash.

Paying in cash will ensure that you really want or need what you're purchasing. Parting with a large amount of saved up money is a difficult thing to do.

It also ensures that you're acting inside your wise money management strategy — you earn compound interest instead of paying it.

If you get to the stage of purchasing your family something life-enhancing with saved up money, it's time to congratulate yourself. You're part of a genuinely elite minority who acts with complete money wisdom!

Keep it up! You're well poised to leave a great financial legacy to your dependants. You also serve as an impressive example to them of how to manage money.

It's Never Too Late To Learn How To Manage Money Better

Money management can be a confusing topic. And it's easy to feel daunted or inferior.

It's easy to feel trapped and overwhelmed, not sure where to start.

Thankfully for you, you now have a roadmap. You have some smart tips which form the basis of a solid money management plan.

All you now have to do is to decide to stick with this, and then to start.

Imagine for a second that the future you, the person you'll be in 20 years, can chat with the current you. What would you say to your younger self?

I'm sure that whatever you say, it will include some encouragement to stick to the financial wisdom in this post.

Society considers those who manage their money well as great people – people to emulate.

It's one of the unspoken truths of our culture. If you want to be regarded as great, show the world that you can manage your money with wisdom and restraint.

Please don't be the guy who 20 years down the line is filled with regret. Commit to getting there, looking back, and feeling proud of how well you managed your money.

Every second of your life, you have an opportunity to turn things around. All you need is a firm decision and a new course of action.

If you decide to implement wise money management going forward, you will:

- Build true financial power,

- Have assets that produce income for the rest of your life,

- Be ready for anything life throws at you, and

- Be a real pillar of support for your dependents.

Society will consider you as someone who succeeded in life. You'll be regarded as great because everyone knows how much discipline it takes to manage your money with wisdom.

Right now, while you're feeling motivated, make your decision. And then use the course of action laid out for you above.

Start managing your money with wisdom today!

Manage money like a pro

bill planning, budgeting, keeping track of accounts, sync and more

Money Pro® for MacMoney Pro

Money Pro® is the next generation of Money app (over 2 million downloads worldwide).

Money Pro is the one place for bill planning, budgeting and keeping track of your accounts. Easy sync with iPhone/iPad versions. Money Pro works great for home budgeting and even for business use.

NOW! Online-Banking*

Connect to your bank and download your data. Money Pro automatically categorizes transactions downloaded from the bank.

* GOLD subscription requiredCalendar

- Mark days on the big calendar when your bills are due.

- Schedule recurring bills with custom periodicity.

- Filter transactions by selecting dates on the calendar.

Today view

- Take a quick glance at bills due.

- When you actually have a transaction, approve it quickly.

- Money Pro predicts transactions for the day that may not have been scheduled manually.

Bills due notifications

- A whole system of reminders will alert you of upcoming bills.

- Quick rescheduling option will help you deal with bills due (tomorrow, in 3 days, next week).

Budgets

- Create budgeted entries, both for your income and expenses, and indicate budget limits for each entry.

- You may set different budget limits for every period, which is useful if you plan to reduce your spending gradually month by month.

- Start adding every transaction you have, and see progress of each category and the overall progress.

- Monitor visual indicators for budget overspending.

- Select the category you want to analyze and examine a budget trend chart generated on the fly.

Budget rollover

- You can set budgets to transfer the leftover of the current period to the next budget period.

- Budget rollover limits your spending automatically if you overspent in previous periods.

Checkbook register

- Unlimited number of accounts in one place (checking, savings, credit card, etc).

- Setting transactions as recurring or as one-time only.

- Balance change history.

- Additional fields for organizing your records including payee, description, check #, class (personal/business travel expenses).

- Attachment of receipt photos.

Account reconciliation

- You can record transactions and clear them later on (reconcile).

- Automatically calculated available balance and cleared balance.

Import of bank statements

- Import history of your transactions and keep your accounts always up-to-date (supported files: .ofx, .csv).

- Money Pro learns how you categorize transactions and predicts categories for the transactions being imported.

Online Banking*

- Connect your banks and download your data.

- Stick to your budget much easier.

- Money Pro categorizes transactions downloaded from the banks.

* GOLD subscription required

Split transactions

- You can split a transaction into multiple categories which is extremely useful when you shop at mega stores and pay for multiple items at once.

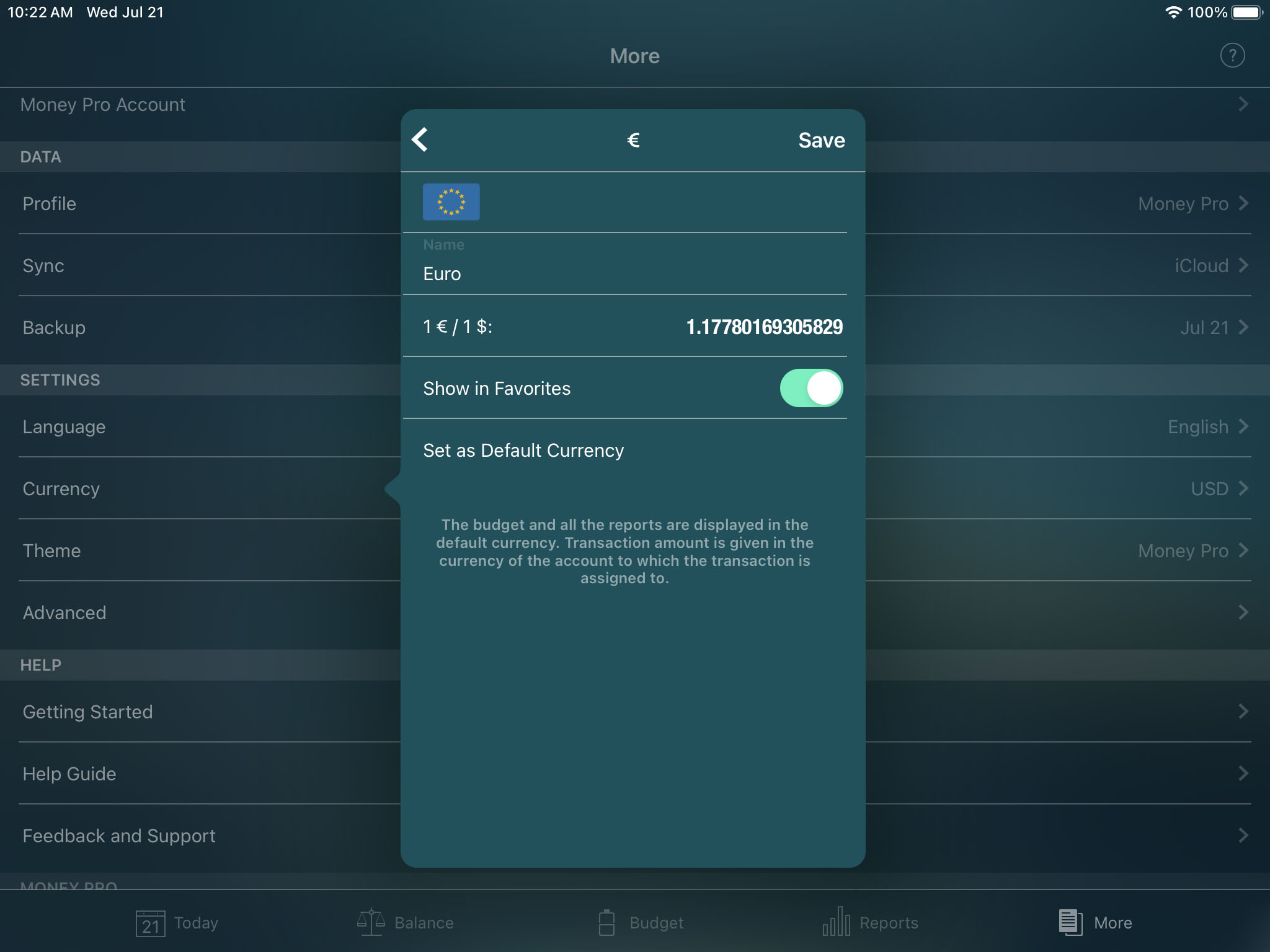

Calculator and currency converter

- Calculate amounts when planning your budget.

- Quick currency conversion when entering transactions.

Search

- Search transactions by amount, category, description, payee, etc.

Lots of options for customization

- Custom periodicity is available for budgeting and bill planning (weekly, biweekly, monthly, etc).

- Adjust the structure of income/expense categories & subcategories for your needs.

- Customize accounts and categories with over 1,500 built-in icons.

- Create your own unique icons using photos.

- Extra themes are available.

Detailed reports

- Income/Expenses

- Cash flow

- Transactions

- Assets/Liabilities (net worth)

- Projected balance

- Net Worth

- Trend chart for days/weeks/months/years

iCloud

- Money Pro uses iCloud to keep your data in sync on your iOS & Mac devices.

Money Pro Sync* (cross-platform & family sync)

- Sync your financial data on all of your devices (iOS, Android, Mac, Windows).

- Track expenses together with your family members or partners.

- Get notifications in real time not to overspend your family budget (business budget).

Archiver 3 0 95. * PLUS or GOLD subscription required

Backups of your data

- Money Pro automatically backups your data at all critical moments.

- You can create backups manually as well.

Money Pro 1 8 – Manage Money Like A Problem

Money Pro 1 8 – Manage Money Like A Product

Multiple profiles

- You can set multiple profiles and track your finances separately for home budget and your small business.

More

- Print and Export to pdf, qif, csv formats

- Password protection

- Multiple currencies support & automatic update of exchange rates

Subscriptions

- PLUS subscription includes Money Pro Sync (required for Profile's owner only).

- GOLD subscription provides two main services: Money Pro Sync and Online Banking.